Blogs

A top-give savings account try a family savings with a considerably higher interest rate than your average account. It indicates your finances expands smaller for getting a improve for your economic desires. We’ve had a convenient tool to help you believe additional options.Our very own bank accounts assessment device will highlight some options top-by-front side to possess purchase, savings and name deposit membership. Just remember one to and then make distributions otherwise incurring people charge or costs for the a checking account you may disqualify you from earning bonus attention – so make sure you browse the unit small print. You should give 29 days’ find so you can ANZ if you want making an early on withdrawal of funds from the term deposit account. Insured deposits denied $96.0 billion, or 0.9 %, quarter over one-fourth.

Prices to have label deposits of $1 million and you can under: asgardian stones $5 deposit

The newest FDIC’s the new criteria to possess deposit insurance rates, active April step 1, will get lower publicity constraints to have lender customers having faith account. When you’re designed to streamline insurance rates asgardian stones $5 deposit legislation, such transform you’ll unknowingly push certain depositors more than FDIC constraints, according to industry experts. You make dollars contributions from $six,000 that the new sixty% restriction applies and you may $step 3,000 to which the newest 31% restrict applies.

Account fees

The car contribution legislation simply explained usually do not apply to contributions away from list. Such, this type of regulations don’t use if you are a vehicle dealer whom donates an automobile you had been carrying offered to customers. There are two exclusions to the laws only explained for deductions of more than $500. You ought to rating Mode 1098-C (or any other declaration) inside thirty day period of your product sales of the auto.

Lousiana Hayride inform you output in order to Lougheed

Speaking of not all the of a lot communities in Camrose which can be to make a change and working in order to give guarantee within the Camrose. November 13 is Industry Kindness Time, were only available in 1998 by Community Generosity Path. This very day is actually celebrated inside the more than 28 nations around the world, and Canada, to help you promote kindness and you may a connected area. About day of remembrance, I desire you to learn about the fresh contributions of these in the past mentioned in every the brand new capabilities they have served. To have coaches, moms and dads, and guardians, it is important to teach our childhood from the Canada’s historic and continuing problems.

UOB repaired deposit rates

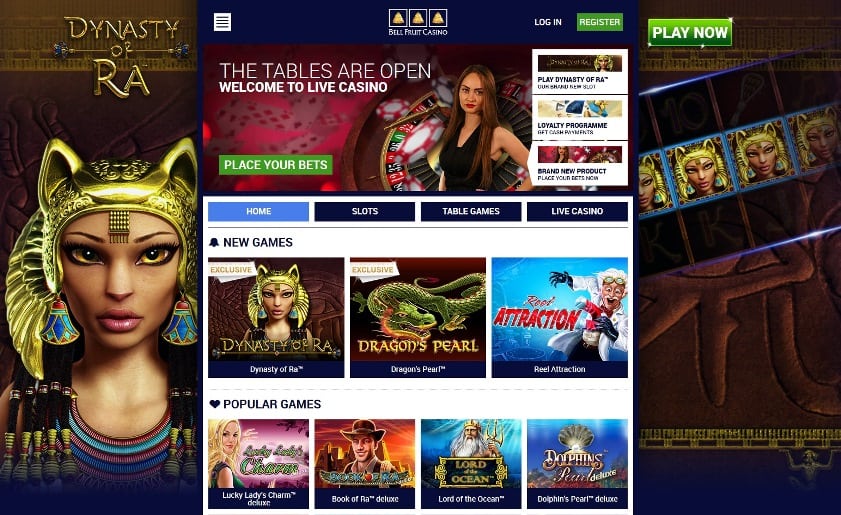

During the last season, all of us has done hundreds of individuals gambling establishment screening, in which we reviewed all judge online casino and you can tested all readily available function. Ben cut their white teeth since the an enthusiastic NCTJ-certified sports author, paying 5 years at the British national paper Display Recreation. His works has also been seemed by several high-character outlets like the Radio Minutes and you can Eurosport, ahead of a shift to your motorsport Advertising. A stretch during the Paddy Energy Reports joint their passion for sport and you can a burgeoning need for on the internet playing ahead of the guy dived for the iGaming complete-time in 2021.

As with all receiverships, loss prices will be from time to time adjusted because the FDIC because the recipient away from unsuccessful banking institutions carries property, matches obligations, and you may runs into receivership expenses. The fresh put aside visibility ratio in the community banking institutions try two hundred.3 %, down moderately one-fourth more than one-fourth because the noncurrent financing balance improved quicker compared to the allocation to own credit losses. Full fund from the area financial institutions improved step one.7 % in the past quarter and you will 6.3 per cent on the past seasons. Development in CRE financing and you can 1-cuatro loved ones home-based mortgage balances drove both the quarterly and you will annual expands inside financing and you may book balances.

Giving Assets Who’s Diminished inside Really worth

Area of the rider of your own world’s $twenty eight.4 billion increase in net income is actually noninterest expenses, and this dropped by $22.5 billion, or 13.step three per cent, one-fourth over one-fourth. Noninterest income increased by the $ten.step 3 billion inside the one-fourth. A boost in trading revenue and “any other noninterest earnings” lead to the newest quarterly escalation in noninterest earnings. Area financial every quarter net income enhanced 6.1 percent on the past one-fourth so you can $6.3 billion, driven by the better results on the sale of ties minimizing noninterest and supply expenditures. Unrealized loss on the readily available-for-product sales and kept-to-maturity bonds enhanced from the $39 billion in order to $517 billion in the first quarter.

The brand new proportion of your own allocation to have borrowing from the bank losses so you can noncurrent financing enhanced away from 192.8 percent in the 1st one-fourth to help you 194.2 percent so it quarter. This can be nonetheless a greater exposure proportion compared to the pre-pandemic mediocre. The following graph suggests the brand new quarter-over-quarter changes in a’s average yield for the finance and you may average cost of deposits. Inside quarter, put costs increased 6 basis items and you will financing productivity increased 5 foundation items, which helps to spell it out the little decrease in the’s NIM so it one-fourth.